Don’t Think You Are Properly Insured

If things go bad you will be counting on your insurance to help you get back on your feet. If you do not have the right coverage you may be left paying a mortgage or car which has been destroyed. This would likely force you into bankruptcy and ruin your financial position for quite some time.

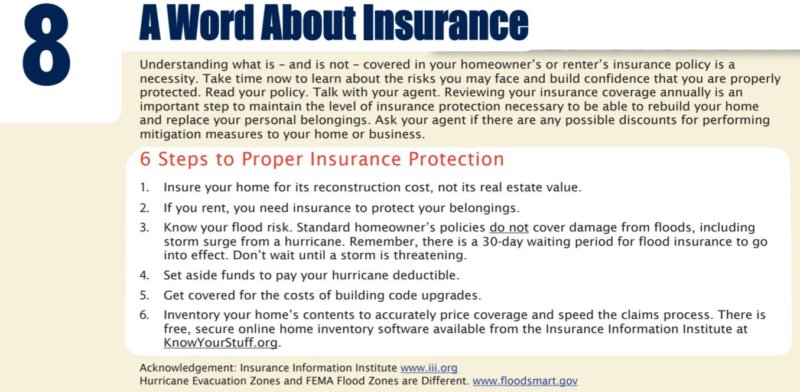

If you live in areas subject to hurricane damage it is extremely important to realize your standard homeowners insurance does not cover wind or water damage. This means if your windows blow out and your home is ruined you will not have any protection.

Meet with your insurance agent

As indicated in this series, the time to meet with your agent is well before a disaster hits. Go over the types of disasters in your area and talk about the coverage that covers you for these disasters. Have the agent show you in your policy where the protection is stated and the coverage financial limit. In Florida, insurance companies have quietly dropped customers in high-risk areas. These customers may not know they are not covered unless they talk to their agent.

If a disaster is looming don’t expect to get an insurance policy. Insurance companies are wise to this approach and are not interested in losing money by writing a last-minute policy that is likely going to be needed.

Source: Pasco County, FL Disaster Planning Guide. www.tampabayprepares.org

Download planning guide here.

Why is the Aftermath Service Needed?

During times of chaos, getting and processing information is critical to decision making. The military trains to make better decisions faster than the enemy. In a mass shooting, earthquake, tornado or hurricane, the enemy is the event. This decision making process is...

Recent Comments